South Korea has rapidly emerged as a powerhouse in the global biopharmaceutical landscape, transforming itself from a generic drug manufacturer to a pioneering therapeutic developer making impressive advancements in cell and gene therapy and biosimilars. And this presents huge potential for international companies innovating in these fields.

Let’s take a closer look at the factors driving Korea’s biopharmaceutical growth and the opportunities they open up.

Korea’s biopharma market

Valued at approximately $22 billion, South Korea’s biopharma market is the thirteenth largest globally, and the country has achieved several outstanding milestones in the industry.

Seoul, for example, was the city which conducted the most pharmaceutical company-led clinical trials in the world in 2022, with the nation as a whole ranking fifth.

And nearby smart-city Songdo boasts the largest biopharma production capacity globally.

A primary catalyst for this market expansion has been strategic, multisectoral investment in bioindustry infrastructure. Between 2020 and 2022, there was an average annual investment increase of 21.6%, bringing total investment in the industry to approximately $2.9 billion. And this surge encompasses both R&D initiatives and critical facility investments, underscoring a comprehensive approach to ecosystem development.

Strategic government initiatives

The South Korean government has played a pivotal role in nurturing the nation’s biopharmaceutical sector. In 2023, it issued the ‘Third Five-year Comprehensive Plan for Development and Support for the Bio-Pharmaceutical Industry’ with the aim of turning Korea into one of the world’s top six pharmaceutical powerhouses.

By 2027, the plan aims to:

- have developed two blockbuster new drugs, each generating approximately $700 million in revenue

- have established three global top 50 pharmaceutical companies

- have doubled pharmaceutical exports to $16 billion

- have created 150,000 high-quality jobs, and

- rank as the third leading nation for clinical trials.

Bio-clusters: incubators for startups

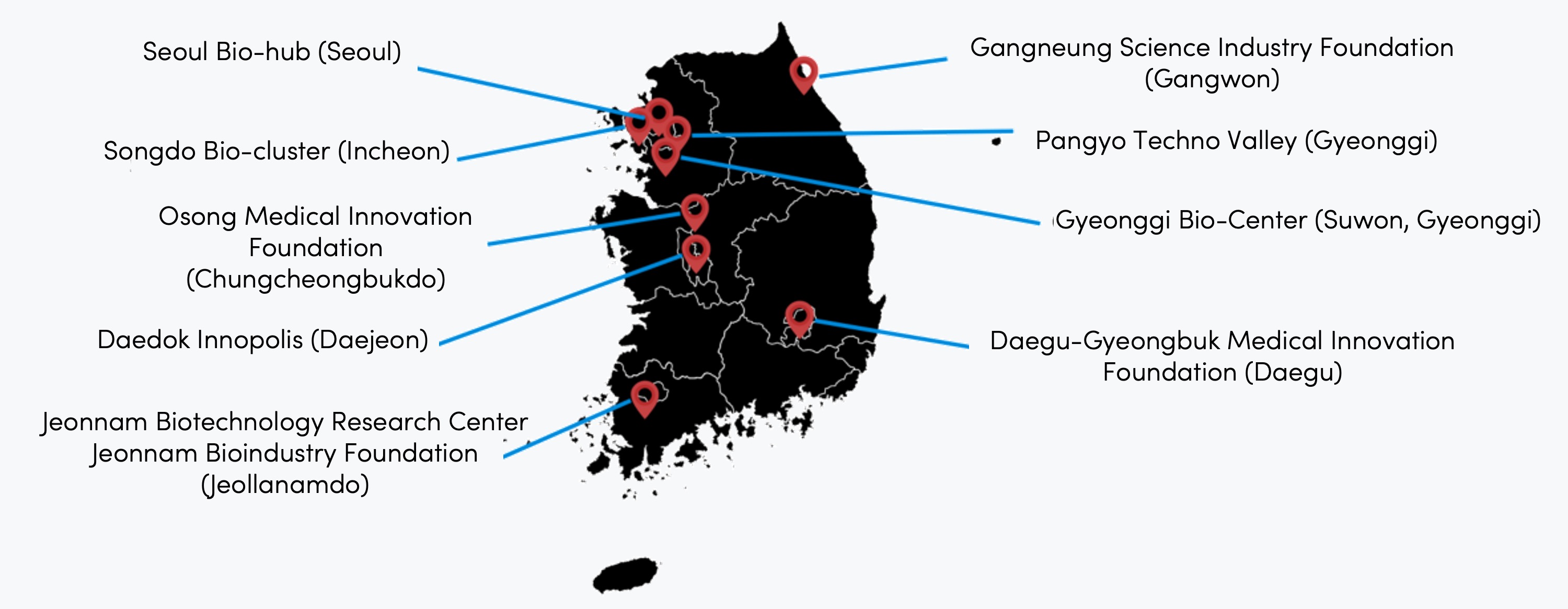

In addition, South Korea's nationwide network of ‘bio-clusters’ plays an important part. These – shown below – are the product of national and local government strategies to create hubs for biomedical innovation. They feature state-of-the-art research facilities, collaborative spaces and advanced manufacturing infrastructure.

Korea's major bio-clusters

Leading companies

With Korea’s robust infrastructure and strong government backing, it’s little surprise that many players are emerging from the country as a significant force in the global industry. And this landscape is characterized by notable advances in biosimilars, manufacturing and cutting-edge therapeutic areas such as cell and gene therapies.

Let’s look at some examples.

-

Biosimilar leadership: Samsung Bioepis and Celltrion

Of 61 biosimilars approved by the American Food & Drug Administration (FDA), South Korea has developed 14 – the second highest number after the US – with Samsung Bioepis and Celltrion standing out. Samsung Bioepis has eight FDA-approved biosimilars including Benepali® (Etanercept), achieving $1.1 billion in revenue in 2024. And, with cumulative revenue of $1.8 billion by late 2024, Celltrion has six FDA-approved biosimilars, including Remsima® (Infliximab), the first monoclonal antibody biosimilar to be approved.

-

Manufacturing giant: Samsung Biologics

Korea’s Contract Development & Manufacturing Organization (CDMO) industry is also rapidly growing, with one of its manufacturing giants, Samsung Biologics, reaching $3.3 billion in annual contract orders in 2024. The company has four plants, with plans to launch its fifth this April, bringing its total capacity to 784,000 liters and adding an antibody-drug conjugates (ADCs) manufacturing capability to its portfolio.

-

Cell and gene therapy: Medipost & Cha Biotech

Currently, 15 cell therapies and three gene therapies have been approved by the Korean Ministry of Food & Drug Safety (MFDS). Medipost developed and commercialized the world’s first allogeneic umbilical cord blood-derived stem cell therapy, Cartistem®, for knee osteoarthritis, achieving $14.4 million in annual sales. And Cha Biotech has licensed its cell differentiation technology to Japanese pharmaceutical giant Astellas for $32 million.

-

More success stories: Alteogen, Ligachem & Orum

Alteogen was founded in 2008 as a first-generation biotech venture, pioneering a remarkable drug formulation platform, hyaluronidase (ALT-B4), which allows the conversion of intravenous drugs to subcutaneous formulations.

LigaChem Biosciences is known for advanced antibody-drug conjugates, with its ConjuAll development recently winning ‘Best ADC Platform Technology’ at the Annual World ADC Awards for the sixth consecutive time. It has secured several tech transfer agreements, including a $700 million deal with Japan’s Ono Pharmaceutical focused on next-generation cancer treatments.

Orum Therapeutics has gained global recognition with its proprietary, dual-precision, targeted protein degradation approach to cancer therapy. After securing a $175.9 million deal with America’s Bristol-Myers Squibb in 2022, it has now entered into a global, multi-target license and option agreement worth up to $975.5 million with global innovative medicine leader Vertex Pharmaceuticals.

Market gaps and opportunities

Despite the government initiatives and successes of Korean pharma and biotech companies, however, there are significant market gaps in Korea, creating major opportunities for international players.

There are particular openings in three primary areas:

-

Unmet needs in therapeutic fields

According to the Korea Drug Development Fund, of 423 R&D pipelines, half focus on oncology, with many of the remainder concentrating on immunology. This has led to unmet needs, particularly in cardiovascular and gastrointestinal therapeutics as well as orphan drugs. This enabled us recently to help a British client to introduce its pediatric orphan drug to the Korean market.

-

Open innovation from large pharmaceutical companies

Several large Korean pharmaceutical companies have highly active open innovation programs. These groups – including Hanmi Pharm, Daewoong, Yuhan, Dong-A ST and GC Biopharma – are collaborating with international pharmaceutical companies to enter overseas markets or conducting joint R&D for new drug development. For example, Korea’s Yuhan has joined forces with Belgium’s Janssen – now part of Johnson & Johnson – to develop and commercialize anti-cancer medication, Lazertinib. And US company MSD has partnered with around 20 Korean pharmaceutical companies for licensing, joint research and co-promotion.

-

Biotech startup collaboration

According to the Korea Bioindustry Information Service, the nation is home to more than 1,000 biotech companies, many of which are startups. A high proportion of the startups are university spinoffs facing challenges in new drug development, such as hit identification, lead optimization, and material scale-up. Their primary objectives are to secure Investigational New Drug (IND) approval and attract investment and, to achieve these aims, establishing proofs of concept and working with international players are often crucial.

Korea’s government programs also encourage collaboration between international companies and Korean firms in such fields.

For instance, the country’s government-backed, AI-driven drug development program includes financial assistance, seminars and networking events to foster global collaboration and support the establishment of international consortia. And we’re supporting this initiative by helping clients submit applications and facilitating communications with the relevant government agency.

Market entry challenges

Despite the considerable opportunities for international biopharma companies, targeting the market inevitably comes with obstacles.

Korean regulations are complex and frequently present an aspiring market entrant with its first major hurdle.

Obtaining useful information through online research can be difficult, as startups often have no websites, while medium-sized and large Korean pharmaceutical companies are reluctant to disclose their early-stage development plans.

And, despite how successfully many Korean firms have expanded globally, language remains a big barrier.

For these reasons, advice from specialists who deeply understand the Korean market is key. You would also benefit from working with people on the ground with strong networks in the industry, and the ability to facilitate commercial discussions and open doors to the right partnerships.

It’s tough to achieve this without an in-market presence.

Conclusion

So, there are many Korean success stories which represent not only a triumph for the businesses concerned but a broader indication of the growing influence of South Korea’s biopharma industry on the international stage.

And the sector’s growth to become a competitive and innovative global force – underpinned by a dynamic economy, a highly skilled workforce and significant government infrastructure investment – is bringing major opportunities for international companies.

Entering the market isn’t necessarily easy. But the potential rewards for companies that take a smart approach are considerable.

This article was written by Sooran Lee and YeEun Rhee, from the Medtech & Life Sciences team at Intralink Korea.

To discuss your prospects in the Korean life sciences market, you can reach Sooran at sooran.lee@intralinkgroup.com, or YeEun at yeeun.rhee@intralinkgroup.com

About the Authors

Sooran Lee

Medtech & Life Sciences, Intralink Korea

Based in Seoul, Sooran helps international firms across pharmaceuticals, CDMO, medical devices, IVD, cosmetics and functional foods expand into Korea.

She began her career practising nursing at Seoul National University Hospital. She then pursued further education in business administration, earning an MBA in Spain. Transitioning into sales and marketing at multinational diagnostics companies including Werfen and BD, Sooran gained marketing experience in the US, China and Korea before going on to lead the global marketing team at Koh Young Technology and launching its neurosurgical robotic systems.

YeEun Rhee

Medtech & Life Sciences, Intralink Korea

YeEun is part of the Medtech & Life Sciences team in Seoul, helping global firms enter the Korean market. Upon completion of her Bachleor’s degree in Biochemistry at the University of Michigan, she began her career at Seoul National University Hospital where she ran clinical trials. She then moved to non-clinical studies, spending the next five years at the Korea Institute of Toxicology (KIT) as a global BD manager supporting chemical and pharmaceutical companies in their product registrations.