This article was originally featured in Startups Magazine.

There are many reasons why the idea of striking a deal with an investor from Japan may feel like a bridge too far. There’s the language barrier … and the cultural differences … not to mention the sheer distance involved. It’s natural, then, that many consider working with such an investor only as part of exploring the Japanese market itself.

However, an early ‘in’ with Japanese investors can have big benefits on a global scale, even if it’s not part of an immediate strategy to sell to Japan.

Why?

Firstly, such investors tend to focus on long-term, strategic returns – such as entry into a new market or acquisition of a new technology. I spoke to several VCs recently, from Japan and elsewhere, who underlined this – adding that sometimes this strategic focus even supersedes short-to-mid-term financial returns (though those are important, too!)

Secondly, Japanese investors offer significant benefits because – unlike those from other countries around the world - they’re often from vastly diversified conglomerates.

You’ll find most Japanese corporations have a plethora of subsidiaries (you can read more about this in the recent article by my colleague Niklas Tawast). And, given this, one open door can lead you through many others – whether it be via a cross-industry connection, a new business case or an unexpected opportunity for co-development.

Thirdly, after a period of economic stagnation in the 2000s, Japanese corporations have found themselves falling behind in new tech development. With innovation and growth thriving elsewhere in competitive international hubs such as the UK’s golden triangle and the USA’s Silicon Valley, corporate Japan is now looking overseas for novel ways to develop new business models and acquire innovative tech to improve their global standing. And this presents a great opportunity for UK companies looking for international backing.

While not all Japanese corporates are at the same cutting-edge of tech innovation as they used to be, their businesses remain formidable in the global marketplace. And their investment in your company may be about building something completely new, or revitalising something well-established. In other words, becoming a part of Toyota’s futuristic air taxi could be just as great an opportunity for you to go global as incrementally improving the Corolla.

Strategic industry focus

Sluggish domestic market growth has also driven Japanese companies to expand internationally, and this is reflected in increased foreign direct investment (FDI) activities, with M&A playing a primary role.

According to the Japan External Trade Organisation (JETRO), Japanese outward investment has seen a steady increase over recent years to reach £110 billion in 2021, making the country one of the world’s largest overseas investors.

And, in this and its broader trade relations, the UK is regarded as a desirable destination. Despite the uncertainties stemming from Brexit, Japan has remained the UK’s fifth largest investor; and trade in goods and services between the two countries totalled nearly £28 billion in 2022.

When it comes to international investments, Japanese corporations have a particular focus on strategic industries including automotive, life sciences and clean energy – with Marubeni Corporation’s commitment of £10 billion to British green hydrogen and renewable power projects a notable example. This plays to the strengths of UK innovators and supports the UK’s broader goals of becoming a tech and science superpower by 2030.

Japan’s companies are also well placed to invest because they have large cash reserves. As of March 2023, the nation’s non-financial corporations held record reserves of more than JPY303 trillion (approximately £2 trillion), giving them the firepower to pursue significant foreign investments and acquisitions.

CVC activity

In addition, Japan has a strong role to play when it comes to corporate venture capital (CVC) investment.

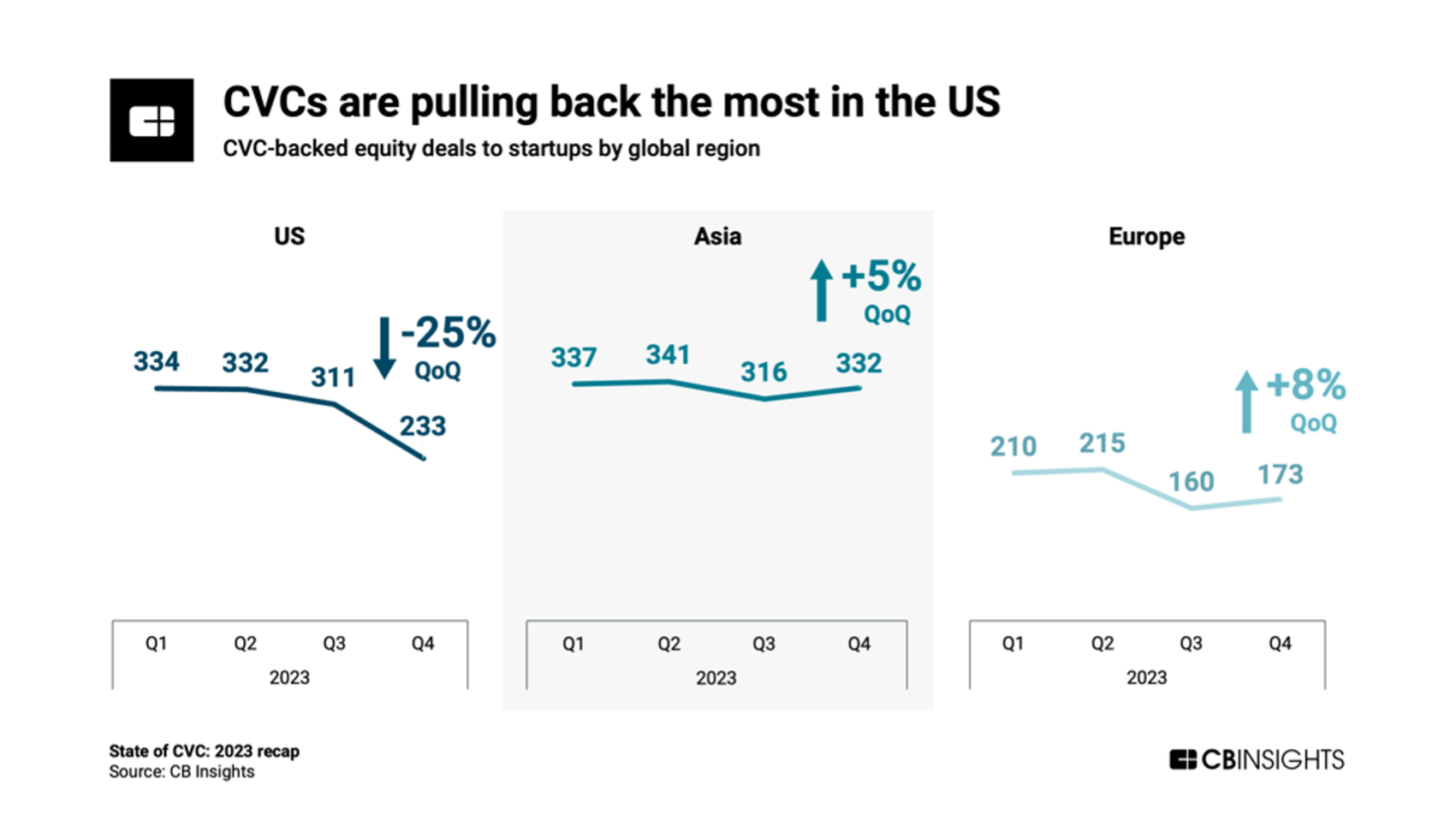

Macroeconomic factors and geopolitical tensions have driven many venture capitalists (VCs) to adopt a more cautious approach of late. ‘Fear-of-making-mistakes’ has become the new ‘fear-of-missing-out’! And this has significantly impacted the US and European venture ecosystems.

Although CVCs have been an important stabiliser in the venture market turmoil, even global CVC-led deals have fallen – especially in the US – to their lowest level since 2019, with a 32% drop year-on-year. Fewer CVCs are emerging, too, with 2023 hitting a six-year low.

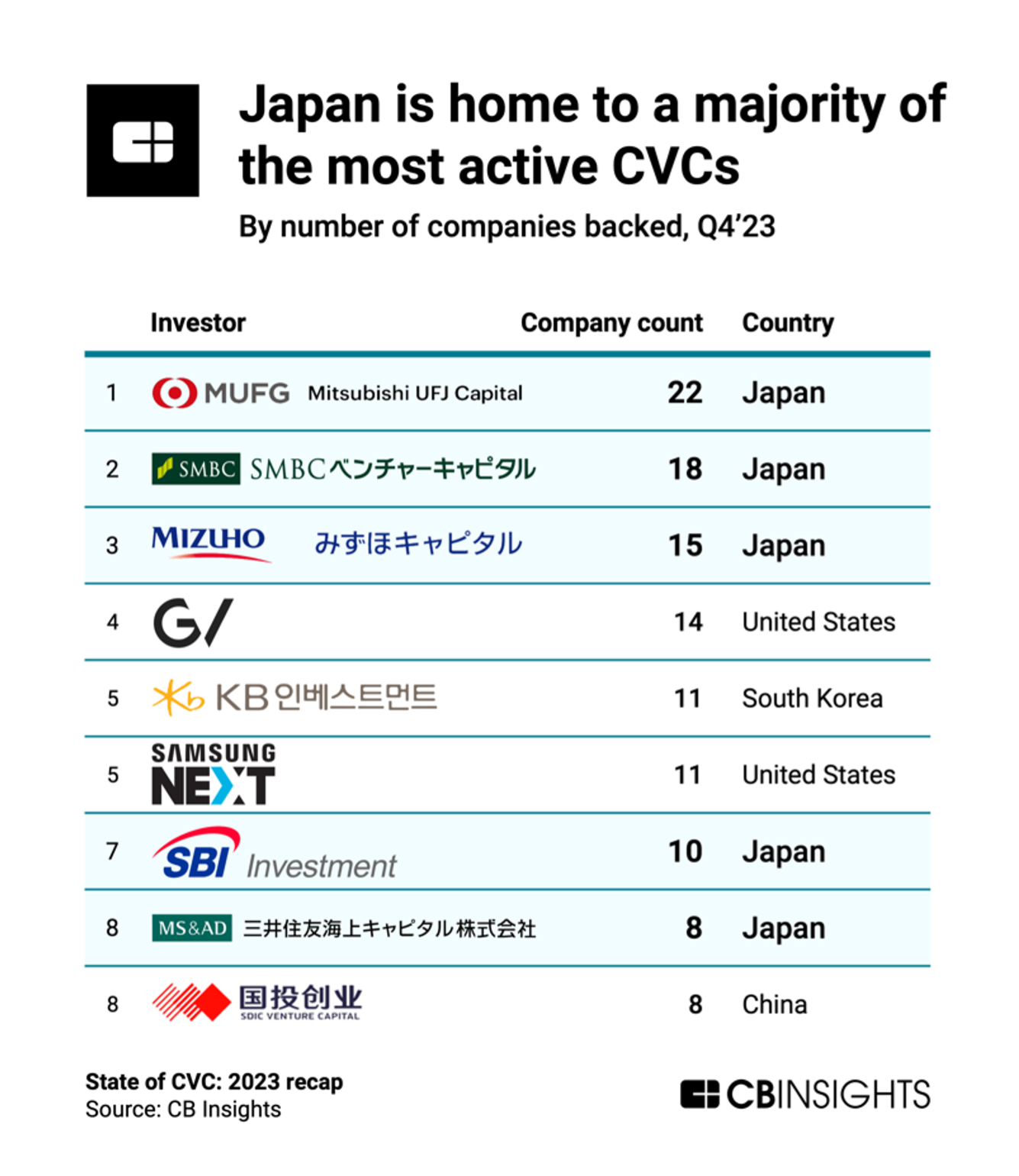

But, among all this doom and gloom, seven of the top 10 most active CVCs worldwide are from Asia. And the top three are from Japan:

Indeed, Japanese companies have increased the capital raised for investing in startups 24-fold over the last decade – and increased the average amount invested in each startup by a factor of five – according to the Japan CVC Report 2024.

We’re still to see the full extent of how this enthusiasm for startup investment will translate internationally, as more than 50% of deployed capital is still focused within Japan. Japanese CVCs are also often considered small on the global scale, with many having less than £75 million of assets under management.

And yet, with corporate Japan’s drive to innovate and strike deals, the CVCs’ parent companies – primarily ranging across the industrial, financial services, IT, healthcare and energy sectors – are expanding their horizons aggressively. And, in doing so, they’re proving uncharacteristically willing to take risks!

No wonder, then, that most recent investments – at least domestically – have been in early-stage (Series A-B), growth and pre-revenue companies.

Tackling the challenges

As much as there are clear benefits from working with corporate investors from Japan, though, let’s not forget the challenges: the cultural and language barriers, the need to understand a complex market and the difficulties of getting to meet the right people in the first place.

If you’re lucky, you might already be in a sector of high interest to Japanese investors. According to Global Corporate Venturing’s report on Japanese CVCs, these are (in order of invested capital): healthcare IT and services (with life sciences topping the list), general IT (software and hardware including semiconductors), agtech and mobility.

There are many success stories in these sectors. But, unless you’re Octopus Energy taking a £180 million investment from Tokyo Gas, approaching a Japanese investor directly might still prove challenging.

And, in contrast to its domestic CVC deals, Japan’s UK investments have mostly been in later stage businesses – such as Oxford Nanopore, which took investment from SoftBank’s Vision fund to boost its valuation to a whopping £2.5 billion ahead of its IPO.

Cost and risk are also important factors to be addressed when seeking Japanese investors, given the expense involved in travelling to Japan and the uncertainty of securing a positive outcome.

The UK-APAC Tech Growth Programme

The need to tackle these hurdles means you’d be wise to tap into the support available, and one good place to start is the UK-APAC Tech Growth Programme.

It’s an initiative we run for the UK government through which our people on the ground in Asia Pacific provide free and subsidised support for high-growth UK scaleups wishing to break into the region’s markets, including Japan.

We provide free market reports and one-to-one consultations, with our Tokyo team on hand to help you understand your potential to attract investment from Japan before you incur significant time and cost exploring the market. They can also run bespoke business development initiatives to introduce you to the most suitable players.

In addition, we’ve brought Japanese companies – including construction giant Shimizu, insurance corporation Dai-Ichi Life and semiconductor leader ROHM – to Britain for UK tech firms to pitch to them. Some of these firms have gone on to explore commercial partnerships.

Considerable benefits

So, there are considerable benefits from seeking investment from Japanese corporations, even if you’re not at the point of selling into the Japanese end market. Besides the credibility uplift that association with a big name can bring, there’s the potential to open up business opportunities in Japan and other global markets.

And, a time when it’s extremely difficult to raise money in the traditional venture capital market, why wouldn’t you explore the opportunity in places like Japan?

To discuss your potential to attract investors from Japan, you can reach Takuya at takuya.gamboni@intralinkgroup.com

Or read more and apply to join the UK-APAC Tech Growth Programme here.